Unparalleled Security and Transparency with Blockchain Technology

Traditional share registries rely on centralised databases, which can be vulnerable to errors, manipulation, and security breaches. Vestra leverages the power of blockchain to create an immutable and auditable record of all share registry activity, ensuring data integrity and building trust.

Our Clients

Vestra SR leverages the power of the Polygon blockchain to create an immutable and auditable record of all share registry activity

Immutable Record-Keeping

Every share transaction, dividend payment, and corporate action has a permanent, unchangeable, timestamped history on the Polygon blockchain, ensuring complete accuracy and preventing any tampering or manipulation. Once a transaction is recorded, it cannot be altered or deleted, providing an immutable record —useful for compliance, due diligence, and transparency.

Enhanced Security & Tamper-Proof Transactions

Vestra SR’s use of the Polygon blockchain and audit trail services ensures tamper-proof transactions. Each action is cryptographically secured, and the decentralised nature of the blockchain safeguards your sensitive data from unauthorised access, modifications, and cyber threats.

Secure & Verifiable Access

All stakeholders have access to the same verifiable information. Shareholders and issuers can independently verify their own data, eliminating the need for third-party verification. This independent verification of transactions and records ensures accuracy and builds confidence throughout the investment process.

Full Audit Trails

Vestra SR provides auditors with a clean, traceable chain of actions, detailing every transaction, modification, and access event within the share registry. This comprehensive audit trail simplifies compliance reporting, streamlines audits, and enhances accountability by providing a clear and verifiable record of all activity.

Features

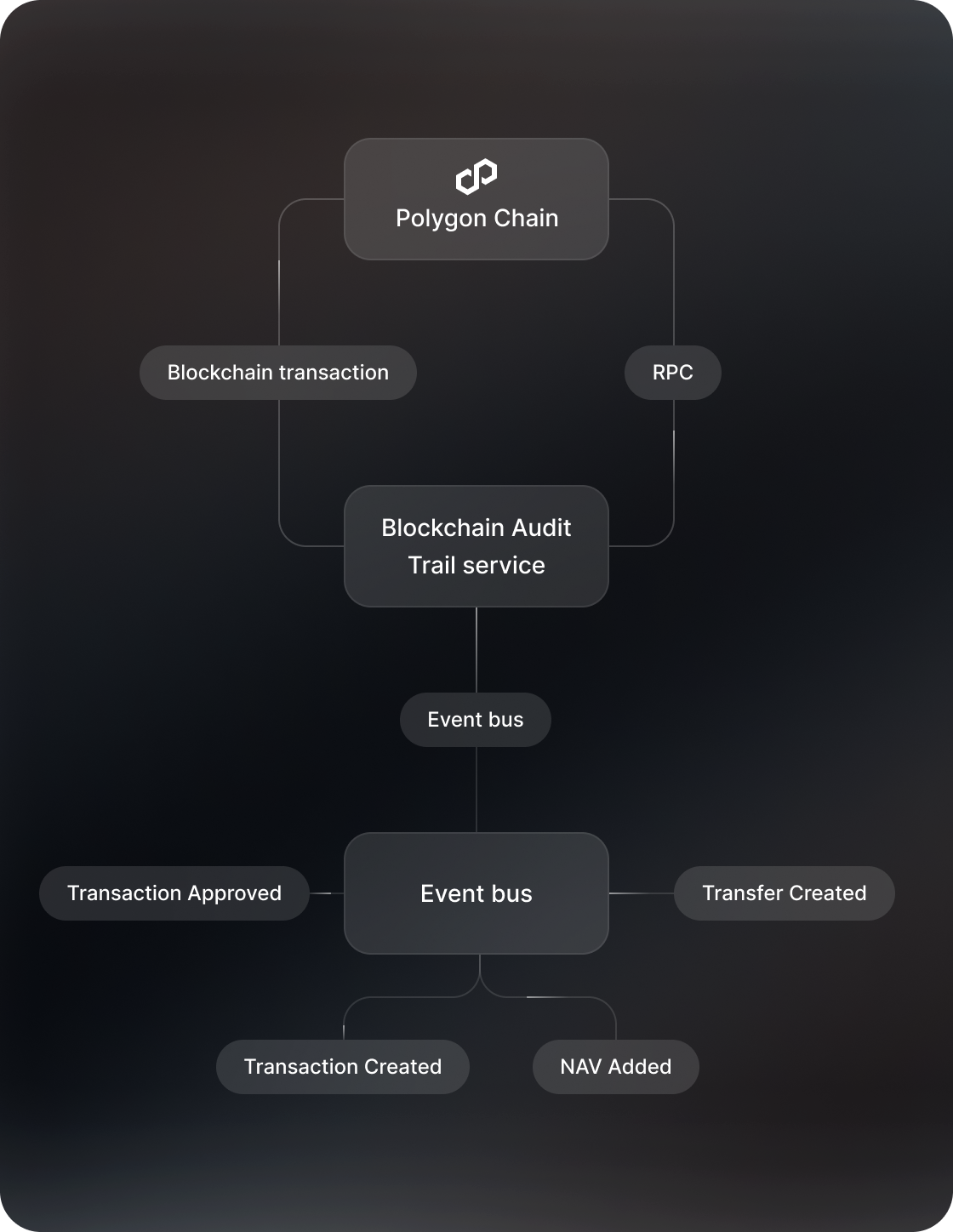

Polygon Integration

Leverages the Polygon blockchain for its low transaction fees, scalability, and compatibility with smart contracts.

Comprehensive Event Logging

Records all significant events, including share transactions, dividend payments, and corporate actions.

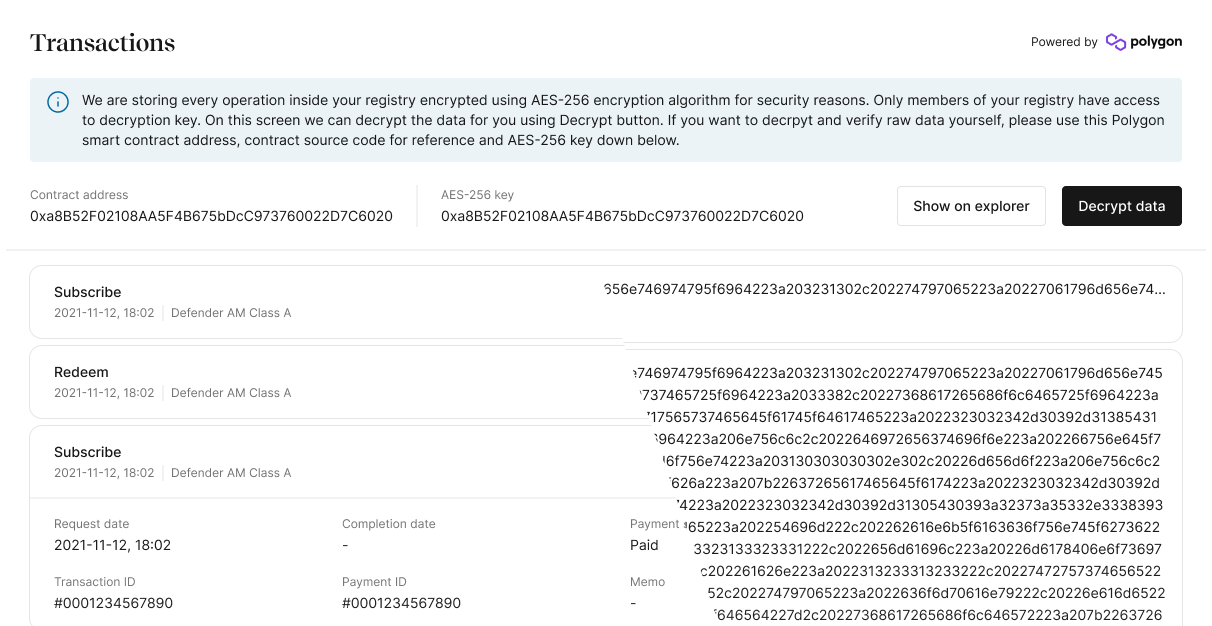

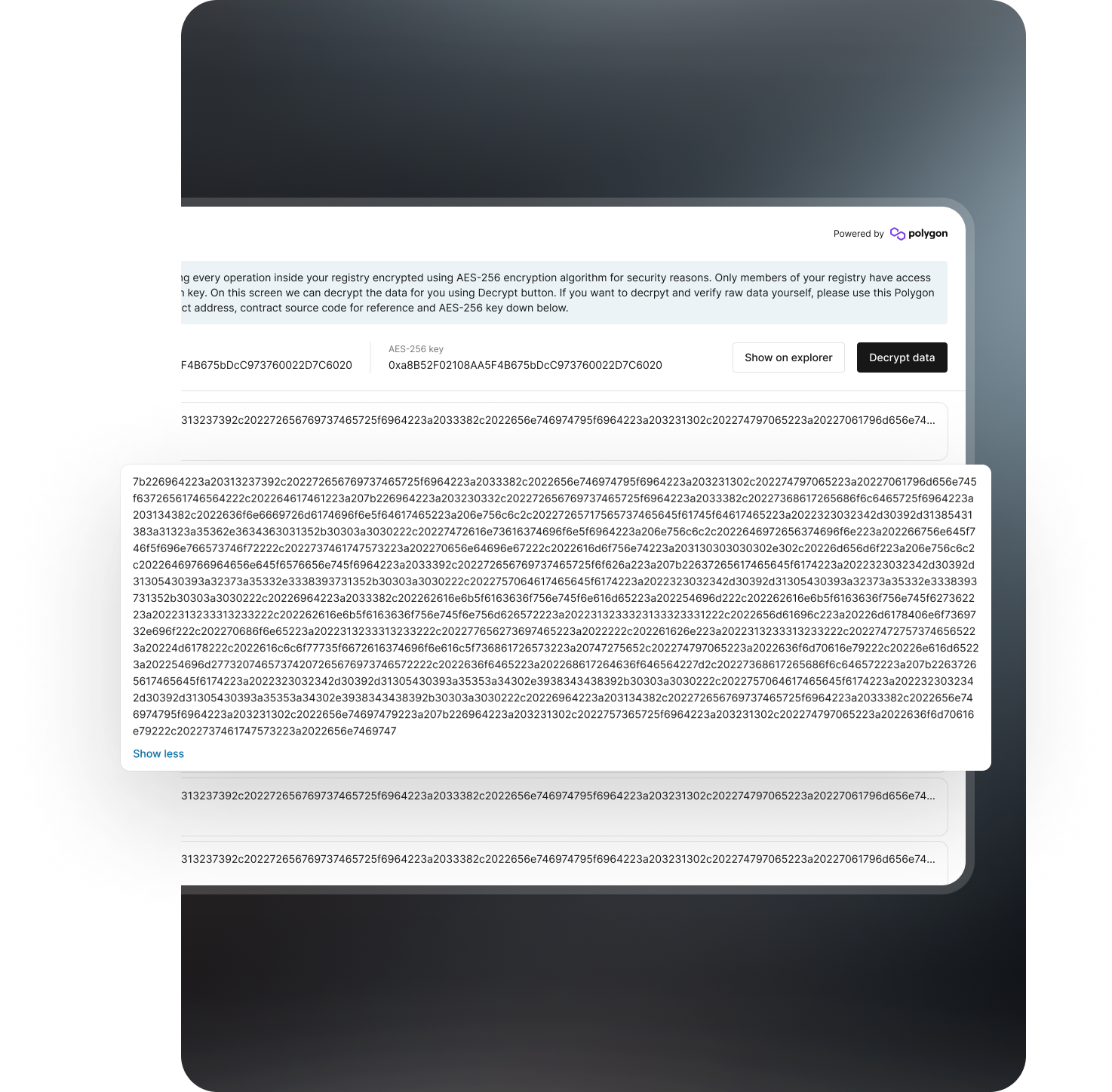

AES-256 Encryption

Data is encrypted both in transit and at rest using AES-256 to ensure maximum security.

Data Access and Verification

Provides users with the tools to access and independently verify the accuracy of blockchain records.

Resilience & Redundancy

Built-in mechanisms prevent data loss or blockchain disruption to maintain business continuity.

Reconciliation Mechanism

Ensures data integrity between the centralised database and the decentralised blockchain.

How Vestra SR Integrates Blockchain

Secure Your Private Shares with Vestra's Multi-Layered Protection System

Transaction Created

A share transaction or transfer is initiated within the Vestra SR platform.

Advanced Encryption

Data is secured both in transit and at rest using industry-leading encryption standards like AES-256 and mTLS.

Granular Access Control

Role-Based Access Control (RBAC) ensures that access is strictly controlled and aligned with user roles.

Proactive Fraud Prevention

Blockchain-backed immutable records and automated alerts work to detect and prevent unauthorised modifications and suspicious activity.

Compliance and Integrity

Vestra adheres to global security protocols and complies with the Australian Consumer Data Right (CDR) framework. Our KYC/AML compliance and Infrastructure as Code (IaC) approach further strengthen our commitment to data integrity and regulatory adherence.

What our customers say

Wayne Collins

Nick Hughes Jones

Mike Bregenhoj

Pricing

Testimonials

Basic

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Basic

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Basic

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Premium

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Enterprise

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Let’s talk

Basic

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Premium

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Enterprise

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Let’s talk

Our Blog

The private share market has long been a cornerstone of wealth-building opportunities, but it hasn’t come without challenges. From cumbersome processes and compliance hurdles to a lack of transparency, traditional investment management practices often leave stakeholders navigating complex and fragmented systems. Vestra addresses these pain points with a groundbreaking approach, leveraging blockchain technology to streamline, secure, and elevate investment management for all stakeholders.

The Role of Blockchain in Investment Management

Blockchain technology offers a decentralised, tamper-proof ledger that ensures every transaction is transparent and secure. For investment management, this translates to clear audit trails, real-time updates, and an immutable record of ownership. Each stakeholder—whether an investor tracking portfolio performance or an issuer managing capital raises—benefits from blockchain’s enhanced security and efficiency.

Transactions on a blockchain cannot be altered retroactively, eliminating the risks associated with manual record-keeping and data breaches. This level of transparency builds trust and confidence among investors and issuers, paving the way for a more streamlined and reliable investment process.

Key Benefits for Stakeholders

Investors: Trust and Transparency

For investors, the primary concern is safeguarding their capital and ensuring transparent returns. Vestra leverages blockchain to provide real-time updates on shareholdings and transaction history. Each investment is recorded on an immutable ledger, ensuring data integrity and eliminating the potential for tampering. This gives investors the confidence to manage and grow their portfolios without uncertainty.

Vestra also simplifies the process of discovering and subscribing to private share offerings. The platform’s intuitive design, coupled with blockchain’s transparency, empowers investors to make informed decisions backed by verifiable data.

Issuers: Simplified Capital Raising

For issuers, raising capital and maintaining regulatory compliance can be a complex, resource-intensive process. Vestra streamlines these tasks with blockchain-powered tools that simplify the creation, pricing, and management of share offerings. By onboarding investors efficiently and ensuring all transactions are recorded on a secure, transparent ledger, issuers can focus on growing their businesses rather than navigating compliance complexities.

The platform also facilitates seamless corporate actions such as dividends, distributions, and buy-backs. Vestra compliance tools ensure that all regulatory standards are met, reducing risk and enhancing investor relations.

Advisors: Improved Portfolio Insights and Data-Driven Advice

Investment advisors need accurate, up-to-date information to guide their clients effectively. Vestra provides real-time insights into client portfolios, allowing advisors to offer data-driven recommendations. Blockchain ensures that all portfolio data is accurate and up-to-date, enhancing the quality of advisory services.

Advisors can also streamline communication with clients through Vestra, facilitating transparent, secure interactions. Comprehensive reporting tools enable advisors to generate detailed reports, optimising portfolio performance and building stronger client relationships.

How Vestra Uses Blockchain for Investment Management

Vestra is more than just an investment management platform; it’s an ecosystem designed to simplify private-share investments. By harnessing blockchain technology, Vestra ensures that every transaction is secure, transparent, and tamper-proof.

Key features include:

- Secure Voting: Blockchain-powered voting enhances shareholder engagement and guarantees tamper-proof outcomes.

- Real-Time Updates: Investors and advisors can access live updates on portfolio performance, fostering informed decision-making.

- Compliance Automation: Issuers gain a comprehensive solution for meeting regulatory obligations with minimal effort.

These innovations empower stakeholders to navigate the private share market with confidence, transforming how investments are managed.

Explore the Future of Investment Management with Vestra

Vestra is setting a new standard for investment management in the private share market. By integrating blockchain technology into an intuitive, user-friendly platform, it bridges gaps between stakeholders and creates a transparent, efficient, and secure environment for investments.

Whether you’re an investor seeking to grow your portfolio, an issuer aiming to streamline operations, or an advisor looking to enhance client services, Vestra is the solution you’ve been waiting for.

Explore the future of investment management today and experience the power of blockchain with Vestra.

Our Blog

Frequently asked questions

Vestra provides tools for real-time portfolio tracking, comprehensive analytics, and secure transactions to help you manage your investments effectively.

You can start by booking a demo through our website or contacting our sales team directly.

What sets Vestra apart from other providers is our commitment to personalised investment strategies tailored to your individual financial goals. We combine advanced technology with expert insights to deliver a comprehensive and seamless investment experience. Our platform offers transparent fee structures, real-time performance tracking, and dedicated support to ensure you have full control and understanding of your investments.

Vestra has a comprehensive security system with authorization based on time-restricted cryptographic signatures and 2FA. File storage is encrypted and has strict access policies, not allowing unauthorized access, with a robust and direct access system minimizing middle-man vulnerabilities and reducing the risk of interception or unauthorized manipulation.

You can start by exploring our platform or contacting our support team for a personalized demo.

Vestra SR is at the forefront of innovation

Experience the future of secure, transparent, and efficient share registry management.